Financial Planning Tips If You Just Got Married

Choosing the correct life partner is a sensitive yet critical consideration. It’s the only way you can have a happily ever after. Although there are numerous ways of defining who a suitable partner would be for you, it’s ideal to look for a loving and caring person who can support you throughout your life.

Read – How to choose the correct life partner?

Lifehack | A perfect life partner, loves and cares for you, and also supports your financial needs and decisions

But not everyone is lucky enough to come across such a person. Often, marriages of people much in love also end up in divorce. And surveys show that one of the most prominent reasons behind the increasing divorce rate across the world is financial issues between partners.

According to Shelby B. Scott’s research, nearly 36.7% of divorces result from couples’ financial differences. So if you’ve found your perfect match, please make sure you align and plan your financial goals for the future with him/her. And if you’re not confident about how to do it, have a look at these tips.

Talk on money matters

Generally, problems arise when both partners are working and don’t have a common financial goal in mind. That’s why it’s important that before you tie the knot, you talk on how you’ll be spending your combined funds. Talk about your interests, spending habits, and saving plans so that both of you are on the same page and don’t go through a rough time in the future.

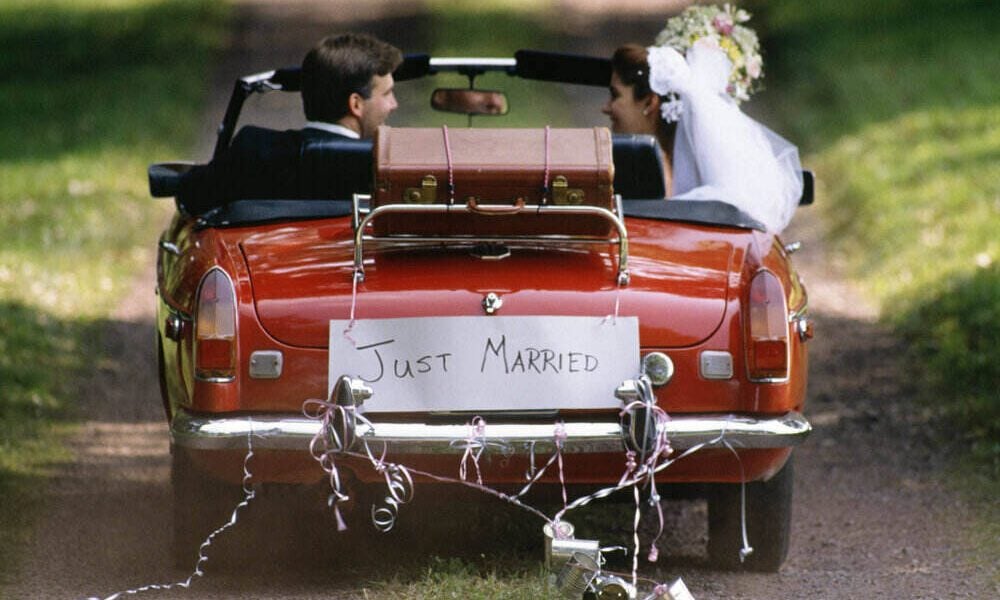

Plan your budget

Budgeting is an important part of any couple’s life. Both of you should talk and discuss your financial goals to figure out how to plan for achieving them. Thereafter, you can engage in practices that reward you constantly so that you stay motivated. There may be shortcomings in the future, which is when you should support and look out for each other.

Money Crashers | To ensure your life as a couple stays smooth, you need effective budgeting and financial planning

Honesty is the best policy

A successful marriage requires both partners to be honest and supportive. Talking about your past financial experiences and how they’ve helped in making you a smarter person is a good way to break the ice. Money is a common reason for disputes in every household, so we should never hide our partners’ financial achievements and failures.

Create a contingency fund

Problems don’t knock before coming, so any newlywed couple must regularly put aside a certain amount of money to deal with unexpected issues. This contingency fund should have equal contributions from both partners, especially when both of them are working.

Plan your retirement goals

You might think it’s too early for having a retirement plan, but keep in mind that the sooner you start planning, the more wishes you can fulfil in the future. Starting early gives you more time in hand and also helps you accumulate a huge amount by the time you retire.

Inc Magazine | Talk to each other about life goals and save together for a comfortable retirement

Read – Daily tips to help you save money

Summing it up

As you begin with a new phase in life, you’ll want to have a secured future, and to build it, you need to be compatible with your partner. A completely transparent relationship has more chances of a success than a non-transparent one. Therefore, loving and supporting each other is the only way ahead, and following this will help in creating blissful memories in the future.

More in Business

-

Cap Table Management Firm Pulley Gets Featured on Forbes’s Top 50 Fintech Startups

Pulley, a San Francisco-based cap table management firm, is swiftly gaining momentum, challenging industry giants and redefining the landscape for startups...

February 27, 2024 -

Redefining Your Path: 6 Essential Steps for Career Reengineering

So, you’re at a crossroads in your career, contemplating a change that could redefine your professional path or perhaps dreaming of...

February 19, 2024 -

Unsecured Loans: A Deep Dive

When financial needs arise, borrowing money can provide a solution. But which loan products make the most sense for your situation?...

February 16, 2024 -

How to Get Back to Work After a Career Break | 5 Tried & Tested Tips

Taking a career break can feel like you have hit the pause button on a movie. The world continues to move...

February 10, 2024 -

Small-Cap Stocks Could Be Your Biggest Win in 2024 – Here’s Why

In the stock market, where titans like the S&P 500 often steal the spotlight with their record-breaking performances, it is easy...

February 3, 2024 -

4 Things We Learned From the 2024 Golden Globes: A Night of Surprises and Inspirations

The 81st Golden Globes, held on January 7, 2024, was an event that transcended the boundaries of a typical awards ceremony....

January 26, 2024 -

The Path to Wealth: How 3 Productivity Tips Led Me to Multimillionaire Heights

In the pursuit of success, one often encounters the timeless question: How do successful individuals maintain such high levels of productivity?...

January 20, 2024 -

Exciting Career Horizons in 2024: Is Now Your Moment?

As we step into the vibrant landscape of 2024, a question bubbles up in the minds of many: “Is now the...

January 9, 2024 -

Here Are the Top 5 Nickel Stocks to Buy

As you venture into the intriguing world of investing, there is a shiny sector that deserves your attention: Nickel stocks. First...

December 31, 2023

You must be logged in to post a comment Login