Is Porting Mortgage a Good Idea? Here’s Everything You Need to Know About It

Purchasing your very first house can be exciting. After all, you might have dreamt of this day for so long and finally, you managed to secure a mortgage.

However, for some of us, the impression that this property is going to be our home forever fades away before the average loan term of 25 years is even over.

Perhaps you’ll come across a better home or you need to relocate for work purposes, but at the same time, you happen to be content with your current mortgage deal. But paying off the mortgage on one house shouldn’t make you feel trapped in your choices. Here’s how you can work this out.

Porting Mortgage

Leaving your current home for another one is possible through the process called porting a mortgage, which allows you to transfer your current mortgage to the new property you’re going to buy. Most loans of this kind are portable, although not all, which means you can carry your term to another deal.

Sometimes, we feel that the first property is our forever home

As per research, two-thirds of borrowers have no idea what it is, while one of five of those who have heard of it do not opt for it because of the scarcity of information.

In hindsight, it technically means you’re bringing with you your mortgage terms onto a new property, but essentially, it means the existing mortgage will be repaid once the current property is sold.

The loan is then resumed on your new real estate. Because you’re basically transferring the deal, you have the same interest and terms and conditions.

When It’s Best to Port Your Mortgage

According to Yorkshire Building Society senior mortgage manager Chris Irvin, porting a mortgage can help save money if the borrower has a loan with early repayment charges or exit fees.

This is especially true if what they’re getting is cheaper than their current property. This option is also attractive to those who are still early into their mortgage period.

You can save money by avoiding exit fees

If you have a neat deal with your current lender or an ideal low rate, then this might be a good opportunity for you. Say you have one of the lowest rates on the market, then carrying your mortgage loan to the new property can be beneficial and save you a ton of money.

When NOT to Port a Mortgage

If you are porting your mortgage just to save money but eyeing a more expensive property than your current house, understand that it could prove to be costly and difficult if you don’t do your homework well enough.

In that case, you may need to borrow more money and need to pass affordability checks conducted by your lender who will check how capable you are of paying back your loans on time. Chances are, the extra sum will come with a higher interest rate.

It is best to compare your current interest rate with others

Plus, it is better if you compare your rates to others just to see if your current deal is still the best in the market. If you’ve spotted a lower interest, it might be high time to ditch porting your mortgage and just find another lender. Bear in mind the fees you’re about to face, like exit and valuation charges.

More in Loans & Mortgages

-

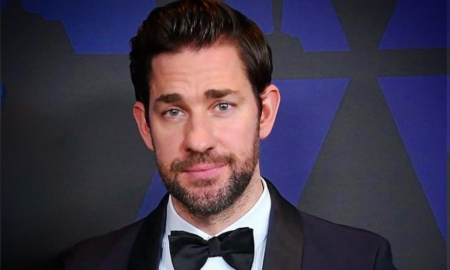

How Much Did John Krasinski Make from “The Office”? Revealing His Earnings

John Krasinski, the charming actor audiences know best as Jim Halpert from the beloved sitcom “The Office,” has amassed a significant...

May 27, 2024 -

How Mortgage Brokers Rip You Off and Ways to Prevent It

Buying a home is a thrilling yet undeniably complex journey. Amidst the excitement of house hunting and envisioning your future life...

May 23, 2024 -

Angelina Jolie’s Plastic Surgery – Debunking Myths and Realities

Angelina Jolie has captivated audiences for decades with her undeniable talent and mesmerizing beauty. Her sharp features and striking cheekbones have...

May 17, 2024 -

How Old Do You Have to Be to Buy a House? Exploring Legal Limits

Dreaming of that perfect place to call your own? A cozy haven bathed in afternoon sunlight, a backyard begging for barbecues...

May 11, 2024 -

How to Quit a Job Without Burning Bridges?

So, it’s time to say goodbye. Maybe you’ve landed your dream job, or perhaps you’re embarking on a new adventure. Whatever...

May 1, 2024 -

What Credit Bureau Does Navy Federal Use for Credit Card Approvals?

When it comes to choosing a credit card, understanding the behind-the-scenes processes can make a world of difference. So, you’re probably...

April 25, 2024 -

Has the FBI Arrested P Diddy? What You Need to Know About P Diddy Arrest

In recent developments that have captivated the public and media alike, the homes of Sean “Diddy” Combs, also known as Puff...

April 17, 2024 -

3 Easy Ways to Cash in Your Savings Bonds

Online With a TreasuryDirect Account In the age of digital banking and online investments, managing your savings bonds electronically is a...

April 11, 2024 -

How Employees Can Be Motivated By Their Own Work?

If there is one question every employee asks, it is: What makes a job fun and motivating? Well, this is not...

April 4, 2024

You must be logged in to post a comment Login