Can You Sell a House with a Mortgage?

Selling a house with an outstanding mortgage can be confusing, especially when it comes to knowing when to stop making mortgage payments. Many homeowners find themselves asking, “Can you sell a house with a mortgage?” The answer is yes, you can sell a house that still has a mortgage.

Let’s dive into the details of how this process works and what you need to know.

Can You Sell a House with a Mortgage? Understanding the Basics

Freepik | When you sell a house, the money from the sale goes toward paying off your mortgage.

When you decide to sell your home before fully paying off your mortgage, the process might seem daunting at first. But it’s a common situation that real estate professionals deal with every day. Here’s what typically happens:

When a house is sold, the proceeds from the sale are used to pay off the existing mortgage. The amount required to settle the mortgage is typically calculated just before the closing. The title company or closing attorney uses the buyer’s funds to pay off the mortgage directly to the lender. Any leftover funds after covering the mortgage and closing costs are given to the seller as profit.

Understanding Your Mortgage Balance

Knowing your mortgage balance is essential for setting an appropriate listing price for your home. If the sale price is less than what is owed, you’ll need to make up the difference, or explore options such as a short sale.

Continuing Mortgage Payments During the Sale

One crucial point to remember: you’re responsible for mortgage payments until the day of closing. This means you’ll need to keep up with your regular monthly payments throughout the listing and selling process, even after accepting an offer.

Why is this important? Mortgage lenders require all payments to be up-to-date at closing. Keeping current on your payments also helps avoid any potential credit issues that could complicate your future home buying plans.

The Closing Process

As your closing day approaches, here’s what to expect:

1. Your lender will provide a payoff statement, showing the exact amount needed to clear your mortgage.

2. At closing, the title company or attorney handling the transaction uses the buyer’s funds to pay off your mortgage directly to your lender.

3. Any remaining proceeds, minus selling costs, are then given to you.

Special Considerations When Selling a Mortgaged Home

Freepik | Be aware of potential prepayment penalties and check with your lender for details.

1. Prepayment Penalties

Some mortgages have prepayment penalties for paying off the loan early. Check your loan terms or consult with your lender to see if this applies to you.

2. Prorated Interest

Your final mortgage payoff will typically include interest prorated to the day of closing. This ensures you’re only paying interest for the days you actually owned the home.

3. Escrow Accounts

If you have an escrow account for taxes and insurance, any remaining balance will typically be refunded to you within 30 days after your loan is paid off.

4. Home Equity Loans or Lines of Credit

If you have a second mortgage or home equity line of credit, these will need to be paid off at closing as well.

Tips for a Smooth Sale

1. Communicate with your lender about your intent to sell and understand their payoff procedures.

2. Work with experienced real estate and mortgage professionals to guide you through the process.

3. Set a fair listing price that covers your mortgage balance and attracts potential buyers.

4. Get a payoff quote from your mortgage lender to know exactly what you owe.

Knowledge is Power in Real Estate Transactions

So, can you sell a house with a mortgage? Absolutely! Selling a home with an existing mortgage is a common and achievable process. By understanding that mortgage payments continue until closing and working closely with real estate and mortgage professionals, you can confidently navigate the transaction.

Whether you’re aiming for a bigger home, downsizing, or relocating, selling your house with a mortgage is entirely possible. With proper planning and expert guidance, you can successfully transition from one home to the next, making your real estate journey smooth and stress-free.

More in Loans & Mortgages

-

`

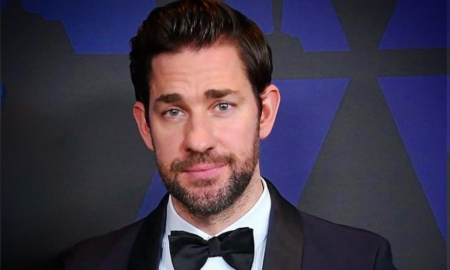

How Much Did John Krasinski Make from “The Office”? Revealing His Earnings

John Krasinski, the charming actor audiences know best as Jim Halpert from the beloved sitcom “The Office,” has amassed a significant...

May 27, 2024 -

`

How Mortgage Brokers Rip You Off and Ways to Prevent It

Buying a home is a thrilling yet undeniably complex journey. Amidst the excitement of house hunting and envisioning your future life...

May 23, 2024 -

`

Angelina Jolie’s Plastic Surgery – Debunking Myths and Realities

Angelina Jolie has captivated audiences for decades with her undeniable talent and mesmerizing beauty. Her sharp features and striking cheekbones have...

May 17, 2024 -

`

How Old Do You Have to Be to Buy a House? Exploring Legal Limits

Dreaming of that perfect place to call your own? A cozy haven bathed in afternoon sunlight, a backyard begging for barbecues...

May 11, 2024 -

`

How to Quit a Job Without Burning Bridges?

So, it’s time to say goodbye. Maybe you’ve landed your dream job, or perhaps you’re embarking on a new adventure. Whatever...

May 1, 2024 -

`

What Credit Bureau Does Navy Federal Use for Credit Card Approvals?

When it comes to choosing a credit card, understanding the behind-the-scenes processes can make a world of difference. So, you’re probably...

April 25, 2024 -

`

Has the FBI Arrested P Diddy? What You Need to Know About P Diddy Arrest

In recent developments that have captivated the public and media alike, the homes of Sean “Diddy” Combs, also known as Puff...

April 17, 2024 -

`

3 Easy Ways to Cash in Your Savings Bonds

Online With a TreasuryDirect Account In the age of digital banking and online investments, managing your savings bonds electronically is a...

April 11, 2024 -

`

How Employees Can Be Motivated By Their Own Work?

If there is one question every employee asks, it is: What makes a job fun and motivating? Well, this is not...

April 4, 2024

You must be logged in to post a comment Login