Sound Investing And Saving Advice: How To Build A Portfolio

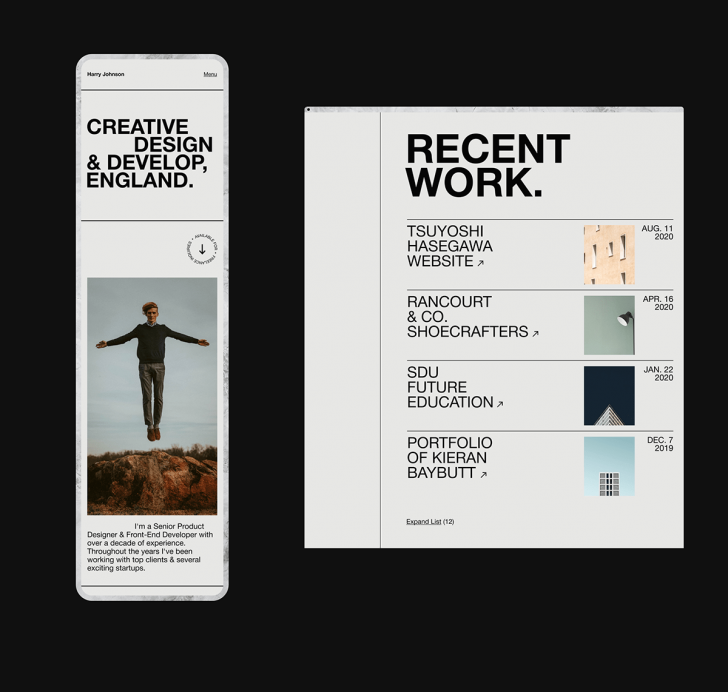

Professional portfolios are a fantastic way to highlight your successes as well as demonstrate your ability to grow. There’s nothing quite like seeing how a professional has developed and embraced creativity to draw in a client. When it comes to your portfolio, each page is a story, and a challenge that you saw and overcame to the best of your ability. Even the mistakes you see now can be part of the narrative: It’s an opportunity to tell a potential client how what you did worked, as well as how you’d approach the problem now, knowing what you know.

During a job search, the portfolio showcases your work to potential employers. It presents evidence of your relevant skills and abilities and is also helpful for independent contractors, consultants, or business owners who need to provide work samples to potential clients. However, although building a portfolio is simple, you should keep in mind a few pointers that will help to avoid common mistakes many others make.

Keep some cash aside for your portfolio

Joshua Aragon/ Unsplash | You can use your portfolio to plan for your life goals such as retirement, child’s education expenses, wedding expenses etc

You can try to save some extra cash, other than saving for your monthly income, rental properties, annuities, pension, social security, investments, etc. This extra cash can be kept in a relatively safe liquid account such as an interest-breaking bank account, money market fund or a certificate of deposit (CD). With the cash in hand, you won’t have to worry about the market or the monthly paycheck. You can then make deposits into your investment accounts and withdraw the funds periodically from your investment portfolio to your savings account. This way, you can also invest the remaining amount in your retirement portfolio.

Balance income and growth

RODNAE Productions/ Pexels | Your portfolio is safer from market ups and downs if you own 10 stocks than if you own just two.

Once your finances are secured, you can start allocating your remaining portfolio to investments that align with your goals, time, horizon and risk tolerance. These investments consists of a mix of stocks, bonds and cash bills that work together and generate a steady stream of retirement income to help maximize your future savings. Pro tip: you can also consider adding dividend paying stocks to your portfolio. Such stocks allow your principal to remain invested for potential growth while offering a steady dividend payment every quarter.

Diversify your portfolio

Behance / Pinterest | The goal of portfolio management is to maximize your returns and minimize your risk

You can maintain your purchasing power over a more extended period by determining the right assets for your investment. Before investing, you should consider some prominent factors such as your income and expenses, while analyzing the risk, the time horizon and tolerance for damage. You can protect yourself by signing up for Treasury Inflation-Protected Securities, or TIPS. The TIPS principle is measured by the Consumer Price Index and increases/decreases with inflation/deflation and your paid interest rate. However, when your TIPS bonds mature, you are paid an adjusted principal over a long period. Adding TIPS to your accounts can help you balance your fixed income or portfolio that are indexed to inflation. TIPS are backed by the U.S. federal government, ensuring a safe and effective way to diversify your investments.

More in Career

-

Ashton Kutcher’s Lucrative Business Ventures

Ashton Kutcher, a name that resonates with the silver screen’s allure, has emerged as a master of diverse talents, not confined...

December 8, 2023 -

Why American Consumers Are Falling Behind on COVID-Era Debt

When the world was grappling with the health crisis brought on by COVID-19, the U.S. economy faced an equally formidable challenge:...

November 27, 2023 -

Dr Dre and Ex-Wife Nicole Young Finalise $100m Divorce Settlement

After months of legal proceedings, Dr Dre, the legendary rapper, producer, and businessman, officially brought his tumultuous divorce from ex-wife Nicole...

November 22, 2023 -

5 Tell-Tale Signs That It Is Time to Say Goodbye to Your Current Job

Are you feeling like your job is more like a ball and chain than a fulfilling career? The daily grind, the...

November 19, 2023 -

WWE Signs $1.4 Billion Broadcasting Contract for SmackDown

In an explosive turn of events, World Wrestling Entertainment (WWE) has just unleashed some earth-shattering news for its legions of fans....

November 9, 2023 -

Navigating the Mortgage Maze as Interest Rates Take a Historic Leap

The U.S. housing market is nothing short of a dynamic entity. It evolves, reacts, and sometimes, just like the current real-estate...

November 3, 2023 -

Celebrity Couples Where the Woman Has a Higher Net Worth

In a world where gender roles and financial dynamics constantly shift, it’s not unusual to find celebrity couples where the woman...

October 27, 2023 -

Why the Gender Pay Gap Could Be Worsening

Picture this: Two college students, Alex and Charlie. Both are bright, have the same interests, and are ready to embrace the...

October 19, 2023 -

JC Penney’s Remarkable $1 Billion Revival Plan

In a remarkable turnaround, JC Penney unveiled a bold $1 billion revival plan, breathing new life into a brand that faced...

October 12, 2023

You must be logged in to post a comment Login