Why Mortgage Application Rates Will Continue To Go Down

It would seem that the real estate market will continue to struggle. That is because I’d the mortgage applications for new houses dropping by 11 percent and this is definitely not something that they want to get into. MBA economists now think that this will of course affect the sales of newly built homes this coming year.

Home Sale Possible Drop

Experts predict that the sales will soon drop unless the mortgage applications suddenly get a boost. The Mortgage Bankers Association said that the United States Census will announce the report before the year ends.

This actually surprised everyone in the business since the mortgage rates dropped in November and hasn’t actually gone up that could affect the mortgage applications. The economy is also doing well despite what is going on with the stock martlet at the moment. It would seem that people are pulling away from the housing market right now with the 7 percent decline in purchase volume.

Experts believe that despite the rate drop, some buyers are still pretty intimidated by the piece of the houses as well as the possible rise of mortgage rates next year. Joel Kan, who is the Vice President of the economic and industry of the MBA, believes that the main reason why buyers are not pushing through in getting a mortgage, is because of the unstable stock market that will surely affect the economy.

This has been a great year for the stock market but as the end of the year approaches, things are far from great. The applications is not the only one that fell, but a lot the applications to refinance. Those who are refinancing have shifted to the lowest rates possible, while those who hasn’t decided yet are most likely waiting and hoping for the rates to go down quickly.

A Time For Change

The National Association of Realtors said that the home sales in the United States even went up last months but compared to the usual, it was considered to be the biggest decline in home sales in the last 7 years. This has been the latest annual drop since 2011, with the 0.6 percent loss in 5.20 million units last month, while the existing home sales that is literally 90 percent of the home sales in the country, went down by 7 percent compared to last year.

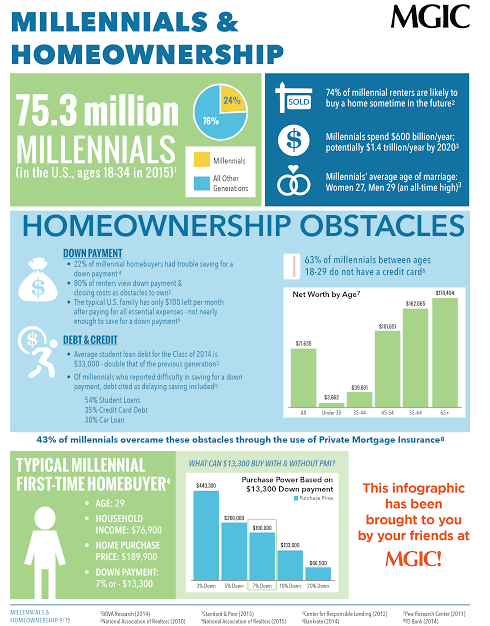

Experts also believe that other than mortgage rates being unstable, the land and labor shortages are affecting it as well. Despite the house price inflation slowing down recently, the number of first-time buyers are decreasing as well. That is because some other experts are not considering the fact that working professionals nowadays are mostly coming from the millennial generation and a lot of studies and surveys have shown that they actually prefer to rent than to get a mortgage.

There are million of working millennials in the country and most of them are in the cities of Seattle, Honolulu, San Diego, and Los Angeles. These cities have a media home price of more than half a million dollars, so technically finding a home will be such a struggle.

According to the Seattle Sustainable Homeownership and Weatherization program’s manager Jennifer LaBrecque, down payment is something that most people are worried about, because that alone can also cost so much. There are also property taxes to worry about, as well as insurance, and other fees and repairs along the way. Homeownership may not be for everyone and some experts believe that millennials in the United States are now mostly in the work force and most of them are already trying to pay for their student debt.

This basically means that one of the major factors as to why home sales and mortgage application will continue to decline is because the time has changed and first-time buyers will most likely prefer to rent than to actually own a property. Some of them will have to pay for their student debt for years, and paying for a mortgage after that for 30 years is not exactly the way most of them want to live. There are also healthcare and emergency funds to worry about and these are considered to be way more important than purchasing their own property, hence they prefer to rent apartments

More in Loans & Mortgages

-

Ashton Kutcher’s Lucrative Business Ventures

Ashton Kutcher, a name that resonates with the silver screen’s allure, has emerged as a master of diverse talents, not confined...

December 8, 2023 -

Why American Consumers Are Falling Behind on COVID-Era Debt

When the world was grappling with the health crisis brought on by COVID-19, the U.S. economy faced an equally formidable challenge:...

November 27, 2023 -

Dr Dre and Ex-Wife Nicole Young Finalise $100m Divorce Settlement

After months of legal proceedings, Dr Dre, the legendary rapper, producer, and businessman, officially brought his tumultuous divorce from ex-wife Nicole...

November 22, 2023 -

5 Tell-Tale Signs That It Is Time to Say Goodbye to Your Current Job

Are you feeling like your job is more like a ball and chain than a fulfilling career? The daily grind, the...

November 19, 2023 -

WWE Signs $1.4 Billion Broadcasting Contract for SmackDown

In an explosive turn of events, World Wrestling Entertainment (WWE) has just unleashed some earth-shattering news for its legions of fans....

November 9, 2023 -

Navigating the Mortgage Maze as Interest Rates Take a Historic Leap

The U.S. housing market is nothing short of a dynamic entity. It evolves, reacts, and sometimes, just like the current real-estate...

November 3, 2023 -

Celebrity Couples Where the Woman Has a Higher Net Worth

In a world where gender roles and financial dynamics constantly shift, it’s not unusual to find celebrity couples where the woman...

October 27, 2023 -

Why the Gender Pay Gap Could Be Worsening

Picture this: Two college students, Alex and Charlie. Both are bright, have the same interests, and are ready to embrace the...

October 19, 2023 -

JC Penney’s Remarkable $1 Billion Revival Plan

In a remarkable turnaround, JC Penney unveiled a bold $1 billion revival plan, breathing new life into a brand that faced...

October 12, 2023

You must be logged in to post a comment Login